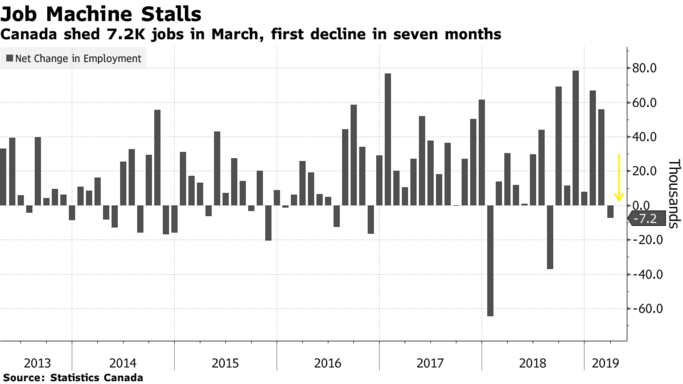

The employment report had long been a lone bright spot in an economy that had sunk across the board, so the March slump is not surprising. According to today’s jobs report from Statistics Canada, employment fell by 7,200 last month, mostly in full-time positions in the service sector. Canada’s jobless rate held steady at 5.8%, close to a multi-decade low and wage growth ticked modestly higher, although, at a 2.4% year-over-year gain, it remains lower than the reading earlier this cycle.

Employment was up 290,000 over the prior six months, so it was only a matter of time that the jobs numbers would reflect the weakness in the overall economy.

Bottom Line: The Bank of Canada will remain on hold and possibly even cut interest rates if the economy slows further. There is little evidence that underlying inflation trends will rise. The headwinds of global uncertainty, weak trade, energy market vulnerability and the housing slowdown contribute to the Bank’s cautious stance.

In another trade loss, China has stopped buying Canadian canola seeds. About 40% of Canadian canola seed exports usually go to China. The Huawei dispute and potential Meng Wanzhou extradition has escalated trade tensions between Canada and China, seriously hurting Canadian farmers. As well, the US tariffs on steel and aluminum exports continue to weigh on the economy. It appears there is little prospect that the renegotiated Canada-Mexico-US trade deal will be confirmed by the US Congress this year, adding to the uncertainty.

All of this has led some to begin calling for a Bank of Canada rate cut. Higher interest rates alongside regulatory changes have already contributed to significantly slower household debt growth and housing markets.

Housing Markets Remain Soft in March in Vancouver and Toronto

According to local real estate boards reporting this week, the end of winter did not spark a flurry of home buying in Vancouver and Toronto. Fragile market conditions deteriorated further in Vancouver where policy measures introduced by all levels of government continue to keep buyers on the sidelines. Home resales fell to their lowest level since 1986 (down another 7% from February), and the benchmark price eased for a ninth-straight month (down 8.5% since the June 2018 peak). Property values in the GVA are likely to remain under intense downward pressure in the near term.

March activity was the slowest in 10 years in Toronto. Resales increased a little less than 2% month-over-month (on a preliminary seasonally-adjusted basis)—minute in comparison to the 13% month-over-month drop in February. A lack of supply could have been a factor holding back activity as new listings fell 4.5% from a year ago. This possible explanation finds some support in the fact that the benchmark price rose at a faster pace in March (2.6% y/y) than February (2.3%)—suggesting that buyers had to bid more aggressively in the face of limited supply.

This winter has been particularly hard on residential real estate markets across most of Canada. The March results published in the last couple of days in Vancouver and Toronto—as well as in Victoria, Calgary and Hamilton—offer little in the way of a meaningful rebound during the all-important early spring season. While recent declines in mortgage rates and the new first-time home buyer incentive announced in the 2019 federal budget could be catalysts for a rise in activity later this year, the stress test and other market-cooling policy actions will continue to weigh heavily on buyers.

We will have more complete data on housing mid-month when the Canadian Real Estate Association releases national and local data.