Canada’s economy is adjusting well to higher borrowing rates and tighter mortgage lending restriction.

That was one of the key messages from the Bank of Canada’s senior deputy governor Carolyn Wilkins in a speech to the Saskatchewan Trade & Export Partnership on Thursday.

She spoke about the BoC’s decision this week to keep interest rates on hold but made it clear that higher rates are coming, albeit in small steps.

Inflation remains the main reason for the rate rise and she reinforced the bank’s assessment that the economy, both domestic and global, is positive.

Ms. Wilkins said that interest rates remain low compared to what would be considered a ‘neutral rate’, which the bank has clarified is in the 2.5-3.5% range.

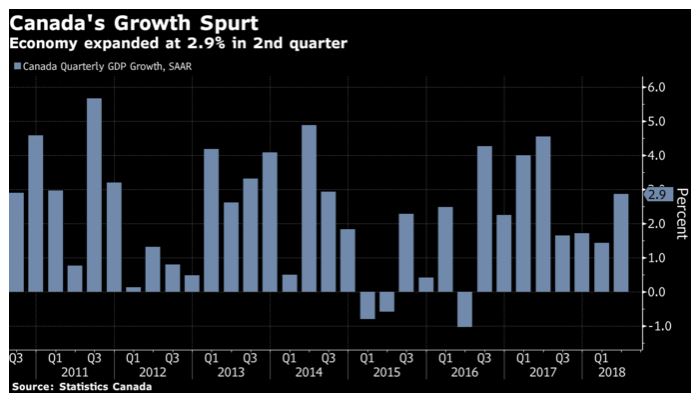

Economy on target but volatile

The Canadian economy should operate near potential over the next couple of years, she added, but said that the quarterly GDP profile would remain volatile for the rest of 2018.

With a spike in exports in Q2 likely to ease and outages in the oil sector also expected to weigh on growth, Q3 data may be weaker; but the BoC is still expecting growth of around 2%.

She said that recent GDP data supported the bank’s decision to increase rates in July and she noted that household consumption and home renovations data showed that Canadians are generally adjusting well to the higher rates.

Housing market stabilizing

Ms. Wilkins spoke about the housing market, noting that there have been impacts of policy decisions on the resale market.

This has been prominent in the Toronto and Vancouver markets but there are signs of improvement, especially in Toronto, but also other urban areas such as Regina and Saskatoon. Vancouver activity and price growth remain subdued.

Overall though, the signs are that borrowers and mortgage lenders are coping with higher rates and tighter mortgage rules.

There is also an improvement in household credit growth and in the quality of new uninsured mortgages.

In conclusion, Wilkins said: “Recent data reinforce Governing Council’s assessment that higher interest rates will be warranted to achieve the inflation target. We will continue to take a gradual approach, guided by incoming data.”

She added that the BoC will continue to assess the impact of higher rates and how that might be changed by NAFTA and other trade policy developments.