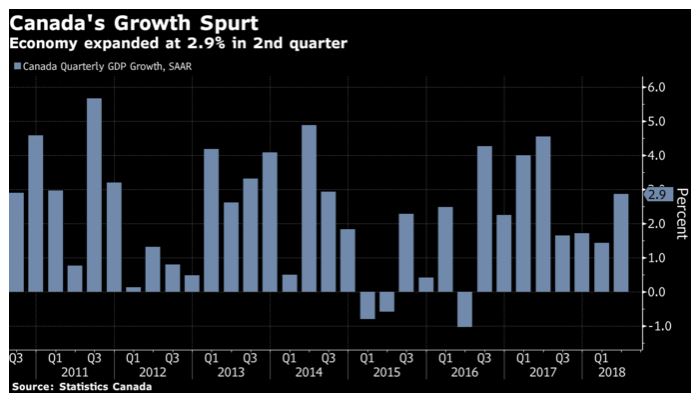

This morning, Stats Canada released the second quarter GDP figures indicating a sharp rebound in growth to its most robust pace in a year. Real gross domestic product growth accelerated to 2.9% (all figures quoted in annual rates), up sharply from the 1.4% pace in Q1. The Q2 result is only slightly above the Bank of Canada’s 2.8% forecast released in the April Monetary Policy Report, tempering the expectation of a BoC rate hike at next Wednesday’s policy meeting.

First quarter growth had been depressed by a plunge in housing* (see note below), which fell by a whopping 10.5% annual rate in Q1. Investment in housing increased to a modest 1.1% annual rate in the second quarter. Declines in ownership transfer costs continued, but at a more modest pace than in Q1, while new residential construction contracted for the first time since the third quarter of 2016. However, these declines were more than offset by a sharp gain in outlays for renovations.

The strengthening growth in Q2 mainly reflected a surge in exports (+12.3%)–the biggest quarterly gain since 2014–due in part to notable increases in energy products and consumer goods, particularly pharmaceutical products. Exports of aircraft, aircraft engines, and aircraft parts increased sharply on higher shipments of business jets to both the U.S. and non-U.S. countries. Exports of services edged down a bit. Net exports (exports minus imports of goods and services) grew at a 6.5% annual rate in Q2 compared to 4.2% in the prior quarter.

Also boosting growth was stronger consumer spending. Household final consumption expenditure (+2.6%) increased at more than twice the pace of the first quarter, reversing the downward trend over the previous three quarters. Growth was attributable primarily to outlays on services (+3.2%), which outpaced outlays on goods. Housing-related expenses (housing, water, electricity, gas and other fuels), up at a 2.4% annual rate, contributed the most to the widespread growth in consumption of services.

Household spending on goods grew at a 2% annual rate following a flat first quarter, with rebounds in semi-durable and non-durable goods. Purchases of vehicles declined at a 2% annual rate. One negative in the consumption numbers may be that the increased spending was financed by a lower household savings rate. The consumer saving rate fell to 3.4% in Q2 compared to 3.9% in Q1 and 4.5% in the final quarter of last year.

Despite the sharp improvement in growth in Q2, market watchers might be disappointed as slowing business investment brought growth in below the 3.5% forecast of some Bay Street economists. The Canadian dollar dropped in immediate response to the report.

Business investment in non-residential structures, machinery and equipment and computers and computer peripheral equipment decelerated to its slowest pace since the fourth quarter of 2016, which might well have reflected the uncertainty surrounding the renegotiation of NAFTA and the imposition of tariffs on a growing number of Canadian exports to the U.S. Business sentiment and investment in capital formation is an important leading indicator of future growth, so the Q2 slowdown bodes poorly for the outlook. Most analysts are forecasting a marked slowdown in GDP growth in the current quarter to less than 2%.

Interest Rate Outlook

In light of the deceleration in business investment, the Bank of Canada has little reason to hike interest rates at the Bank’s next policy meeting on September 5. Investors are betting that a rate hike in October is a near certainty according to Bloomberg Canada.

Bank of Canada Governor Stephen Poloz played down inflation worries and the prospect of aggressive interest rate increases last week at a Fed conference in the U.S. Poloz argued that the recent spike in inflation to 3% in July, the highest in the G-7, was due to transitory factors that would eventually be reversed. The wage measures in today’s GDP report, along with the separate May employment earnings numbers, point to the Bank of Canada’s ‘wage-common’ measure rising 2.4% in Q2, little changed from the increase in the first quarter.

Even though Canada is bumping up against capacity constraints and labour shortages are rising, Governor Poloz appears to be in no hurry to bring interest rates all the way back to non-stimulative levels. He has repeatedly made a case for gradualism citing heightened uncertainty over geopolitics and trade as well as economists’ inability to measure critical parameters like potential growth.

The Bank of Canada has raised its benchmark interest rate four times since July 2017 to cool the economy, and market indicators suggest investors are expecting as many as three more hikes over the next year, after which the central bank is anticipated to go into a long pause. That will leave the target for the benchmark rate, currently at 1.5%, at 2.25%–below the 3% “neutral” rate the Bank estimates as a final, non-stimulative resting place for overnight borrowing costs.

Notes:

*Housing investment in the GDP accounts is technically called “Gross fixed capital formation in residential structures”. It includes three major elements:

- new residential construction;

- renovations; and

- ownership transfer costs.

New residential construction is the most significant component. Renovations to existing residential structures are the second largest element of housing investment. Ownership transfer costs include all costs associated with the transfer of a residential asset from one owner to another. These costs are as follows:

- real estate commissions;

- land transfer taxes;

- legal costs (fees paid to notaries, surveyors, experts, etc.); and

- file review costs (inspection and surveying).